The analysis of the trend for main raw material of PowderCoatings

2016-07-26

1. Polyester Resin

23th Jul. 2016, PTA product index was 45.79, descended 55.94% comparing with the period high 103.92(15th Sep. 2011) and rose 11.87% comparing with the period low 40.93(26th Aug.2015).(Remark:the period means since 1st Sep.2011 up to now)

Status and forecast: At present, PTA price rose about 50RMB up to about 5000RMB/T, NPG price keep stable at around 9100RMB/T and will maintain relatively smooth adjustment, IPA decreased slightly 200RMB to 13000RMB/T. Due to the raw material is fairly stable, and the weak demand from downstream in summer, the current pricing principle is cost plus, polyester prices will keep stable in August.

2. Epoxy Resin

25th Jul. 2016, epoxy chloropropane product index was 49.32, descended 50.68% comparing with the period high 100(1st Sep.2011 ), rose 0.96% comparing with the period low 48.85 (30th Jun. 2016).

(Remark:the period means since 1st Sep. 2011 up to now )

Status and forecast: Epichlorohydrin seems difficult to get out of the stalemate pattern. There are good and bad news on the market at the same time, but the impact is not strong enough. The support of the cost has not become epichlorohydrin factories delivery base line. So even in a loss, factories can only ship goods in order to digest the inventory. In addition bisphenol A is quite stable, the downstream epoxy market may adjust some how. G20 Summit will also influence the volume in August, so the price is not possible to keep rising. The epoxy resin will ship steady and weakly shake in a short-term.

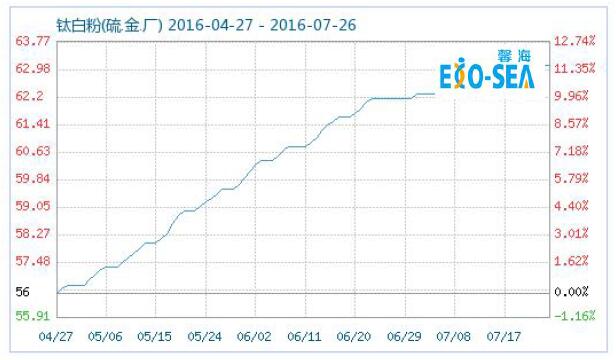

3. Titanium dioxide

25th Jul. Titanium dioxide index was 63.12, descended 36.88% comparing with the period high 100(4th Sep.2011 ), rose 22.14% comparing with the period low 51.68(29th Dec.2015 ) (Remark:the period means since 1st Sep. 2011 up to now)

Status and forecast: The price of titanium dioxide is still reasonable for the existing policy and market environment. The supply and demand relationship will not change a lot in the future, so the motivation of market price rise is from the wishes of the manufacturers and the good policy. The eight times rise in this year were mainly rely on export support. The devaluation of the RMB and the continuous price rising of the raw titanium materials made the domestic downstream market somewhat passive, so far the total rise is more than 30% since this year. But the actual demand has begun to decline. The manufacturers which rely on the domestic market to digest inventory may face more pressure. The goods holders are relatively calm on the price rising. Titanium dioxide is expected keep stable in the short term, probability of price rise is not much. The following trend might be clear in mid of September.

4. Curing Agent

TGIC:At present, the TGIC chlorine price will adjust in a low base, but as per the cost caused by the summer limit, TGIC supply falls short of demand. The price will rise in the August.

HAA, the price of the main raw material DMA and DEA are both rising , HAA price will rise as well.