The analysis of the trend for main raw material of PowderCoatings

2016-06-24

1. Polyester Resin

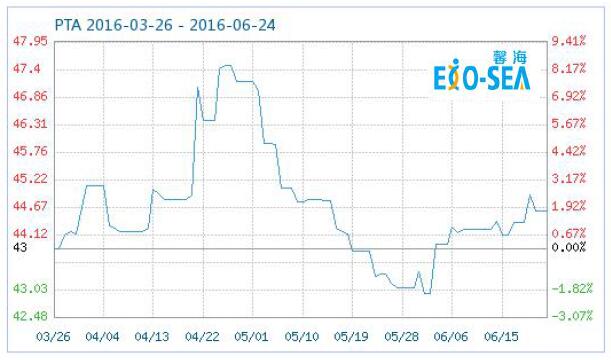

23th Jun. 2016, PTA index was 44.60, descended 56.17% comparing with the period high 101.75(22nd Sep. 2011) and rose 12.06% comparing with the period low 39.80(26th Aug.2015).(Remark:the period means since 1st Sep.2011 up to now)

Status and forecast: PTA price is slightly lower than 5000RMB/T, relatively keep stable adjustment, NPG price maintains at 9100RMB/T, IPA price maintains at 13000RMB/T, TMA rose a little bit. Due to the raw material is fairly stable and the weak downstream demand in June , the most domestic manufacturers expected the price will keep stable in July.

2. Epoxy Resin

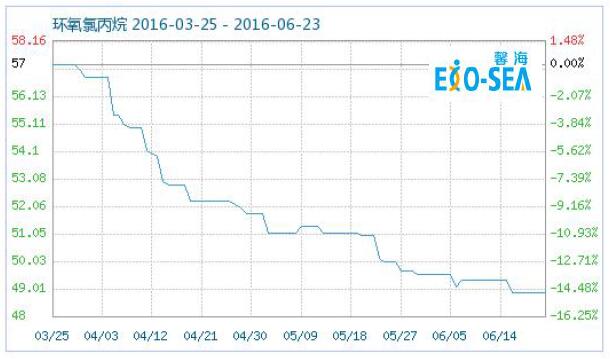

23rd Jun. 2016, epoxy chloropropane product index was 48.85, create the period low, descended 51.15% comparing with the period high 100(1st Sep.2011 )

(Remark:the period means since 1st Sep. 2011 up to now )

Status and forecast: Although the part of domestic chlorine factory stop production, but because of high stock of the market and poor operating rate of downstream factories, the expectation is not optimistic in the short-term. In addition bisphenol A rose 600 RMB/T, mostly solid epoxy resin factories stop production in order to reduce the inventory pressure. Especially around the Dragon Boat Festival holiday, downstream demand is even weaker. Most domestic manufacturers have enough inventory. With the shipping pressure, low price goods flooded into the market. The market will adjust in a low base in the short-term, and epoxy will keep stable.

3. Titanium dioxide

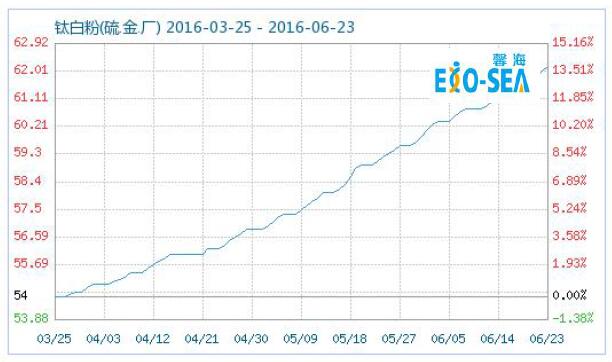

23rd Jun. 2016 Titanium dioxide index was 62.17, descended 37.83% comparing with the period high 100(4th Sep.2011 ), rose 20.30% comparing with the period low 51.68(29th Dec.2015 ) (Remark:the period means since 1st Sep. 2011 up to now)

Status and forecast: In the first half of June, the operating rate of titanium dioxide was not significantly improved, the most manufacturers’ inventory is low. Which caused the seventh wave of price rise. But with the market demand slowdown, the traditional market low season coming, the export reduction caused by the oversea holiday season, and the European "carcinogenic storm", all influence the titanium dioxide export and supply in a certain extent. The traders will prepare goods more cautiously, and the inventory pressure will be transferred to the manufacturers. Which will push the market into a reasonable supply and demand balance. For the current situation, the future market is difficult to be changed in a short-term. The domestic economic performance is stable, the external market negative factors might reduce. Many manufacturers are still running pre-orders, only little new turnover. The overall market is weak and price rise become difficult without enough good market prospect. The domestic titanium dioxide market price will temporarily under adjustment, with some low-end price or sporadic price rise.

4. Curing Agent

TGIC:At present, the TGIC chlorine price will adjust in a low base, but as per the cost caused by the summer limit, TGIC price may rise in June.

HAA, the price of the main raw material DMA is quite stable and DEA rise a little. HAA price will keep stable in the period.